The origins of the 4x ATM sector that we know currently came about following the move away from fixed currency exchanges to new ‘floating’ currency prices in the early 1970’s. Since this time the marketplace area has steadily grown, with interest fueled by advances in technologies such as telephone dealing and of program pcs. These have permitted for ever added participants to enter the sector put.

Foreign Exchange is not one central market put. As a substitute it is comprised of a network of rather a couple of thousand trading institutions comprised of Central Government financial institutions, Worldwide financial institutions, personal and industrial businesses and devoted brokers. Whilst there is no central place associated with 4x ATM, most trading is based mostly all around vital trading centres. The most necessary of these are regarded as receiving London, New York, Tokyo, Hong Kong, Singapore and Frankfurt.

When there are a quantity of large players who make use of the currency markets for business dealings and investment, 4x ATM is also accessible to the smaller investor. Access to deal on 4x ATM has been produced probable by new trading regulations which govern offered transactions sizes and changes to monetary laws.

The Interbank trading size of $one hundred,000 dollars per round lot has now been damaged down into smaller sized tradable great deal sizes. Compact traders can now consider control of these plenty by way of ‘leverage’. The volume of leverage you will be provided by a broker will usually rely upon your trading experience. Even so, usually a leverage of one hundred:1 will be provided. This indicates that even with a reasonably small deposit of $1000 you will be capable to handle a $one hundred,000 dollar currency exchange.

So why have so lots of traders begun to trade on these markets and what are the vital rewards for an investor?

Accessibility

the forex marketplace is open about the clock, 24 hours a day, five days a week. You can place transactions on the markets at any stage for the duration of this time. Trades can be executed via your private laptop or computer across the On the web in just a matter of second.

Substantial Liquidity

in contrast to stock investments, currency trading is unbelievably ‘liquid’. The higher quantity of transactions on the sector place around the clock implies that there is usually a purchaser or seller for a specific currency so you will have no troubles in receiving your orders filled no matter what time of day it is.

Open Market place put

the sector is regarded as ‘open’ and ‘transparent’. Currencies moves are dictated by news movement and adjustments in the outlook for nationwide economies. There can be no ‘insider trading’ as this data is readily accessible to each trader of the industry place at the precise very same time.

No commission fees

the value of every single single transaction is presently developed into each and every and each trade and is known as the brokers ‘spread’. This is the distinction amongst what a currency pair can be purchased at and what it can be offered at.

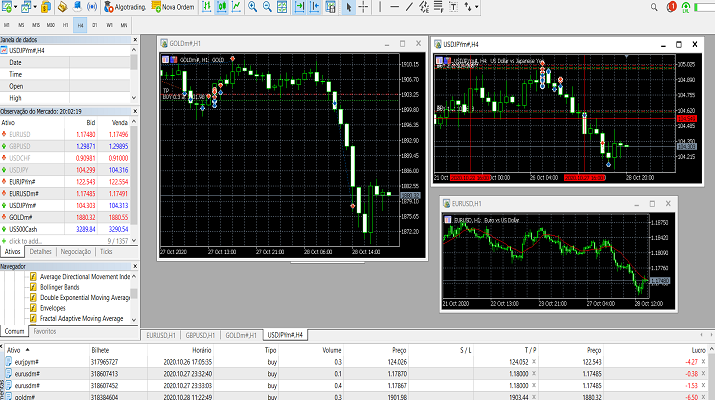

Currencies are consistently traded in pairs – the US dollar against the Japanese yen, or the English pound against the euro. Each transaction will involve selling 1 currency and getting an additional, so if an investor believes the euro will achieve against the dollar, he will promote dollars and get Euros.

Currency trading generally consists of selling one currency and acquiring a various. For this purpose you will generally see currency costs quoted in pairs, for instance the Euro against the US Dollar (EUR/USD).

If a trader believes that the outlook for the Euro seems a great deal much more favourable in relation to the dollar, he will get Euros and offer dollars. This would be acknowledged as going ‘long’ EURUSD.

The doable to generate earnings exists from identifying these shifts in valuations. The continual fluctuations of the markets presents tons of choices to earn earnings. You can recognize these occasions by the use of the two simple parts and technical evaluation as element of your trading.